Workers’ compensation insurance protects employers from claims resulting from injuries to employees. It protects your business from lawsuits and provides employees with compensation for on-the-job injuries.

By law, most employers are required to provide coverage for lost wages and medical bills incurred as a result of on-the-job accidents or illnesses. For many businesses, workers comp coverage is the largest part of its insurance expense.

Workers Compensation FAQ’s….

What does a workers compensation policy cover?

Workers compensation policies provide a number of very important coverages. Among these are the following….

A). Coverage for employee injuries. If an employee is injured on the job a workers compensation policy will provide coverage for the injuries sustained by the employee. The employee must have been injured in the scope of his/her employment for coverage to apply. With most workers comp policies, the medical benefits do not have a dollar limit.

B). Lost wages. Workers comp policies will also cover lost wages of employees who are out of work as a result of a job-related injury. The amount paid to the employee is limited to a percentage of their pre-injury compensation and lost wages are limited to 10 years.

C). Rehabilitation expenses. Workers comp policies will often provide coverage for rehabilitation expenses following an injury.

D). Loss of consortium. Workers compensation policies will sometimes provide coverage for the spouse &/or family members of employees seriously injured on the job. When a physically injured person cannot as a result provide his or her spouse with the services, companionship, love, affection, and sexual relations enjoyed before the injury – a loss of consortium claim may be presented.

I have a General liability policy – will that cover an injury to my employee?

No. General liability policies will not cover injuries sustained by employees. General liability policies will cover injuries to third parties, but not injuries to employees.

What factors determine the cost of a workers compensation policy?

The cost of a workers compensation policy depends on several factors. Several of these factors are listed below….

A). The state where the business is located in (or where most of the work is performed in).

B). The type of work the business performs – i.e. carpentry, clerical, etc.

C). Amount of company payroll (i.e. a company with a 800k payroll will pay more than a company with a 200k payroll).

D). Claims history & Experience Modification Factor (see below).

What is an “Experience modification” factor?

In a nutshell, your Experience Mod compares your workers’ compensation claims experience to other employers of similar size operating in the same type of business.

It’s the method for tailoring the cost of insurance to the characteristics of a specific business, but it also gives that business the opportunity to manage its own costs through measurable cost saving programs.

How is an Experience Mod calculated?

The actual process of calculating the Experience Mod is complex, but the purpose of the formula is pretty straightforward. Here’s how it works: your company’s actual losses are compared to its expected losses by industry type. Factors taken into consideration are: company size, unexpected large losses and the difference between loss frequency and loss severity.

Your Experience Mod is calculated by the National Council on Compensation Insurance (NCCI) or in some states, by an independent agency. Experience rating is a mandatory plan that applies to all employers that meet a state’s premium eligibility criteria for the Plan. Experience rating calculations are computed by NCCI.

How does my Experience Mod affect my premiums?

Your Experience Mod represents either a credit or debit that’s applied to your workers’ compensation premium. A Mod of 1.0 is considered to be the industry average. While a Mod factor more than 1.0 is a Debit Mod, which means your losses are worse than expected and a surcharge will be added to your premium. An Experience Mod under 1.0 is a Credit Mod, which means losses are better than expected, resulting in a premium discount.

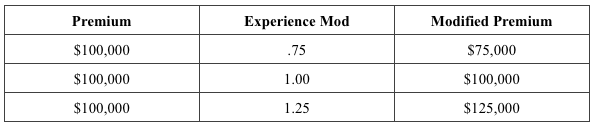

Here’s an example of how this works:

As you can see, an Experience Mod of 1.25 would mean that insurance premiums could be as high as 25% more than a company with an Experience Mod of 1.0.

Are workers compensation premiums tax deductible?

Generally, workers compensation insurance premiums are tax deductible business expenses. Of course, we encourage you to confirm this with your tax advisor as the laws can vary from state to state.

When am I required to have a workers compensation policy?

Virginia law requires every employer who regularly employees three (3) or more full-time or part-time employees to purchase & maintain workers compensation insurance. The state of Maryland (with few exceptions) requires every employer with one (1) or more employees to purchase & maintain workers compensation insurance. Washington DC also requires employers with one (1) or more employees to purchase & maintain workers compensation insurance.

I don’t have any employees – why would I want a workers comp policy?

Even if you do not have any employees, you can still sustain an injury to yourself. Without a workers comp policy you may be in real trouble.

Example: A house painter falls off of a ladder while painting a house. The painter sustains a broken neck and can no longer work. Who pays the painter’s medical bills? Who covers the painter’s lost income? Answer – the workers comp policy.

I’m the owner of my company – can I elect to exclude myself from coverage?

Yes. As the owner of a company, you can elect to include or exclude yourself from coverage. The benefit of excluding an owner from coverage is the cost savings (the owner’s payroll is not included in the premium cost calculation). The disadvantage of course is that the owner will not be covered should something happen.

In the state of Virginia – sole proprietors are automatically excluded from workers compensation coverage unless they opt-in. The opposite is true of corporate officers – they are automatically included unless they elect to formally exclude themselves from coverage.

I’ve heard of something called a ghost policy – what is it?

A so-called “ghost policy” is a workers comp policy issued for a business with no employees and the owner of the business excludes him/herself from coverage. You may ask, why would anyone purchase a ghost policy? – they are purchased primarily so that the insured can provide proof of workers comp coverage to a third party (usually a General Contractor). A ghost policy is sometimes referred to as a “certificate policy” because they are typically purchased by an insured with the sole intention of providing a certificate of insurance to a third party. Ghost policies will provide coverage for any newly hired W-2’d employees that have yet to be added to the workers comp policy.

I have a good health insurance policy – isn’t that enough?

Health Insurance policies differ from workers comp policies in the following ways….

A). Health Insurance policies usually have deductibles – often very high deductibles. Workers comp polices on the other hand usually have no deductible.

B). Health Insurance will not pay for wages lost during an injury. Workers comp on the other hand will pay for lost wages up to 10 years.

C). Health Insurance will generally provide coverage for any type of injury or illness sustained by an insured. Workers comp policies on the other hand will only cover injuries sustained by employees in the scope of their employment.

D). Workers Comp premiums are tax deductible – health insurance premiums generally aren’t.

I heard that one of the benefits of a workers comp policy is that employees do not have to sue their employer to collect benefits. I also heard that employees are barred from suing their employer if the employer has an active workers comp policy – can you explain this?

If an employee is injured and his company does not have a workers compensation policy in place, the employee may be forced to sue his employer in order to recover benefits. This can be a “lose/lose” situation for both employee & employer. If a lawsuit is brought by the employee, the employee generally must show some type of negligence on the part of the employer. This can sometimes be a heavy burden on the employee (not too mention the awkwardness of suing your employer while in some cases still working for them).

If an employee is injured working for a company that has a workers compensation policy in place – the employee does not have to file suit and prove that the employer acted negligently. This is a nice benefit to the employee.

From the employer’s standpoint – as long as they (employer) have a workers compensation policy in place, the injured employee is barred from filing suit against them. The employee’s sole remedy is to file a claim through the employer’s workers compensation policy. This provides an added incentive for employers to purchase workers compensation insurance.

Want to see how much we can save you? Just request a quote to find out.